Was this email forwarded to you? Sign up here!

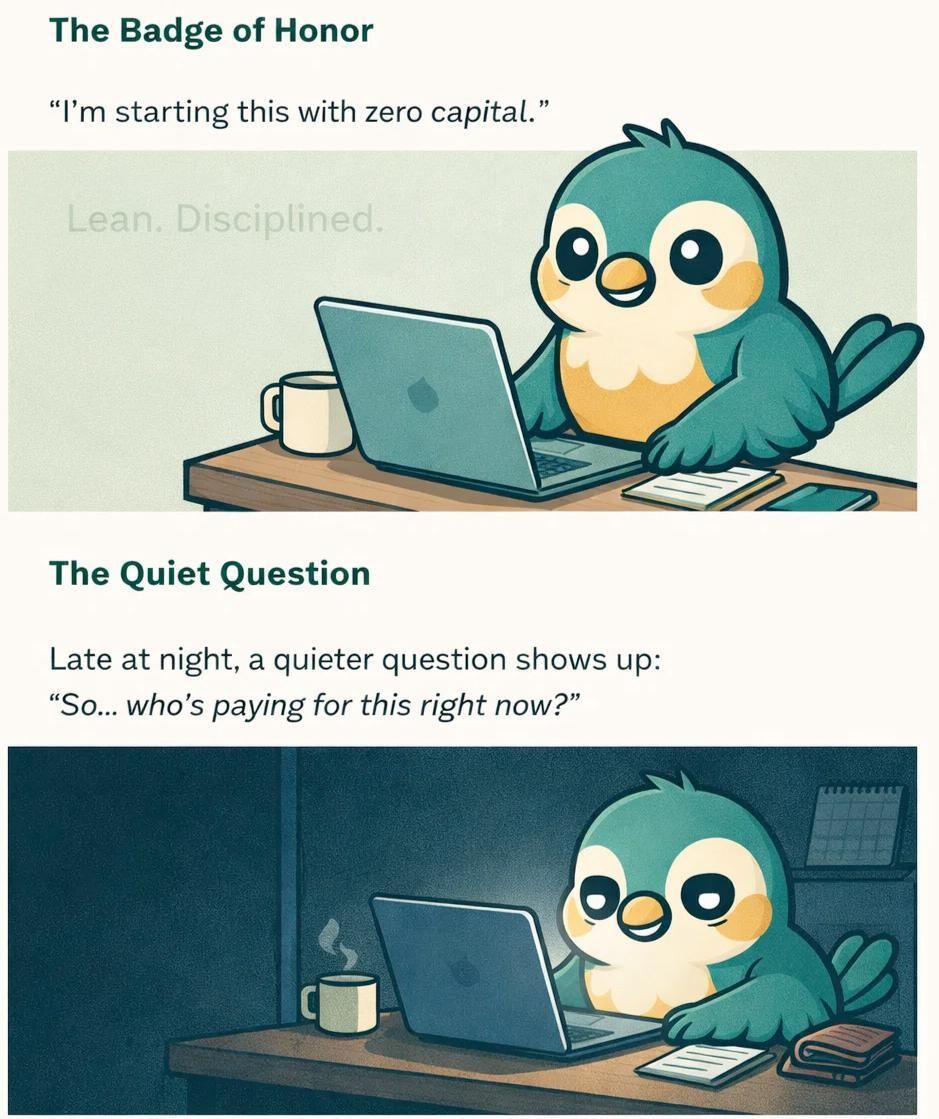

The $0 Capital Myth

The phrase “$0 capital” hides a dangerous misunderstanding.

Because every business costs something before it stabilizes:

Time

Energy

Stress tolerance

Opportunity

Cash (eventually)

When founders say, “zero capital,” what they usually mean is:

“I’m funding this with myself instead of money.”

That’s not wrong.

But it comes with rules most people never write down.

The Reality (The Reframe)

There are only two ways a business can start:

Cash comes in before costs go out

Costs come first, revenue comes later

1️⃣ When Starting With $0 Actually Works

$0 capital works only when you can get paid before or as you incur costs.

This usually means:

Services

Consulting

Freelancing

Coaching

Agencies

Pre-sold offers

In these models:

Customers fund survival

You sell first, then deliver

Revenue acts like capital

2️⃣ What You’re Still Paying (Even at $0)

When you start with no money, you’re paying with:

Unpaid labor

Delayed income

Personal financial risk

Emotional bandwidth

Fewer second chances

$0 capital isn’t free.

It’s just unpriced risk.

3️⃣ The Rules (If You Choose the $0 Path)

If you break these, the model breaks you:

Get paid before work starts (deposits, retainers, pre-sales)

Keep costs variable, not fixed

Narrow the offer until it sells easily

Deliver fast, then reassess

Know the moment you must stop and fund properly

Discipline replaces money here.

4️⃣ When $0 Capital Is a Lie

Some businesses cannot start this way:

Physical products

Inventory-heavy models

Manufacturing

Brick-and-mortar

Regulated operations

If costs must exist before revenue, capital must exist before starting.

The Real Question to Answer

Starting with $0 doesn’t make you disciplined.

Starting honestly does.

The real question isn’t: “Can I do this with no money?”

It’s: “Who is carrying the risk, and for how long?”

Community Note

This issue wasn’t about budgeting.

It was about risk placement.

Some businesses borrow money.

Some borrow belief.

Some borrow time from the founder’s life.

Knowing which one you’re building changes how you plan, and how you sleep.

👉 Reply and share:

A win you had starting with $0

Or the moment you realized $0 wasn’t sustainable

We’re turning real founder experiences into the NestLedger Playbook.