Was this email forwarded to you? Sign up here!

Don’t Let April Sneak Up on You Again 🧭

If you’ve been busy building and serving customers and pushed the books to “later”, you’re not alone.

That’s why we’re running the 14-Day ProfitNest Tax-Ready Challenge.

No rushing. No guessing. No last-minute scrambling.

Just short, focused steps to turn a year of activity into clean, reliable numbers you can actually trust.

We start on February 10th. ☺

→ Join the 14-Day Challenge

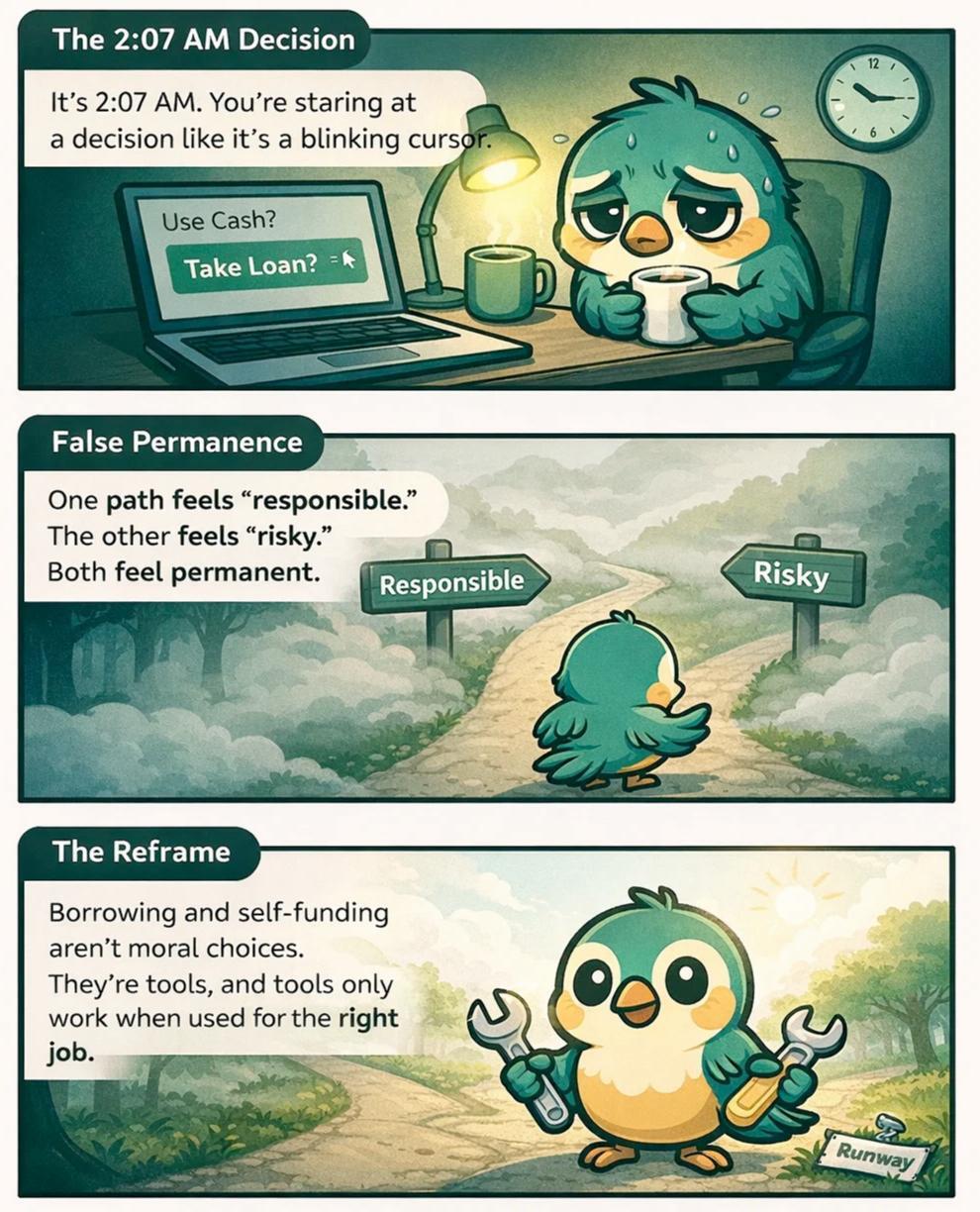

Oxygen vs. Muscle

Think of your business like a body.

Cash flow is muscle. It’s a strength you’ve already built.

Borrowing is oxygen. It keeps you moving when the climb gets steep.

You don’t bring oxygen tanks to a casual walk.

But you don’t free-climb Everest on lung power alone either.

The mistake founders make:

Using oxygen for short walks or trying to sprint uphill while holding their breath.

Borrow or Self-Fund?

When to Use Business Cash Flow

Self-fund when the spend is:

Predictable – You know the cost and the outcome.

Short-term – Payback inside 3–6 months.

Non-essential – Nice to have, not life support.

Operational – Tools, small hires, routine upgrades.

👉 Rule of thumb:

If the expense won’t directly increase cash inflows soon, don’t drain your reserves for it.

Muscle fatigue is real. Overuse it, and you’re weak when it matters.

When Borrowing Makes Sense

Borrow when the spending is:

Growth-linked – Inventory, sales hires, marketing with clear ROI.

Time-sensitive – Waiting costs more than interest.

Revenue-backed – You can see how cash returns to repay it.

Runway-protecting – It keeps your core cash untouched.

👉 Borrowing is smart when it buys time or momentum, not comfort.

Debt used to grow cash flow is leverage.

Debt used to avoid hard decisions is quicksand. 💳

Tactical Moves You Can Use This Week

Tag every big expense: “Does this protect runway or produce revenue?”

Map the payback window: If you can’t explain repayment in one sentence, pause.

Set a floor: Never spend cash below your minimum survival balance.

Match tool to job: Short ROI → cash. Long ROI → borrowing.

Review quarterly: The right answer changes as your business evolves.

Highlight Box: Quick Decision Filter

Ask this before you choose:

Will this make or save money within 90 days?

If revenue stalls, can I still sleep at night?

Does this keep my business breathing freely?

If the answers feel tight in your chest, don’t self-fund it.

Community Note

Every founder wrestles with this.

The confident ones just learned it the hard way once and took notes. You’re doing the smarter version, thinking before the leap.

👉 Reply and tell me the next expense you’re debating.

I’ll send you our Borrow vs. Burn Decision Sheet, a one-page tool to sanity-check the call before money leaves the nest 🪺.