Was this email forwarded to you?

Sign up here!

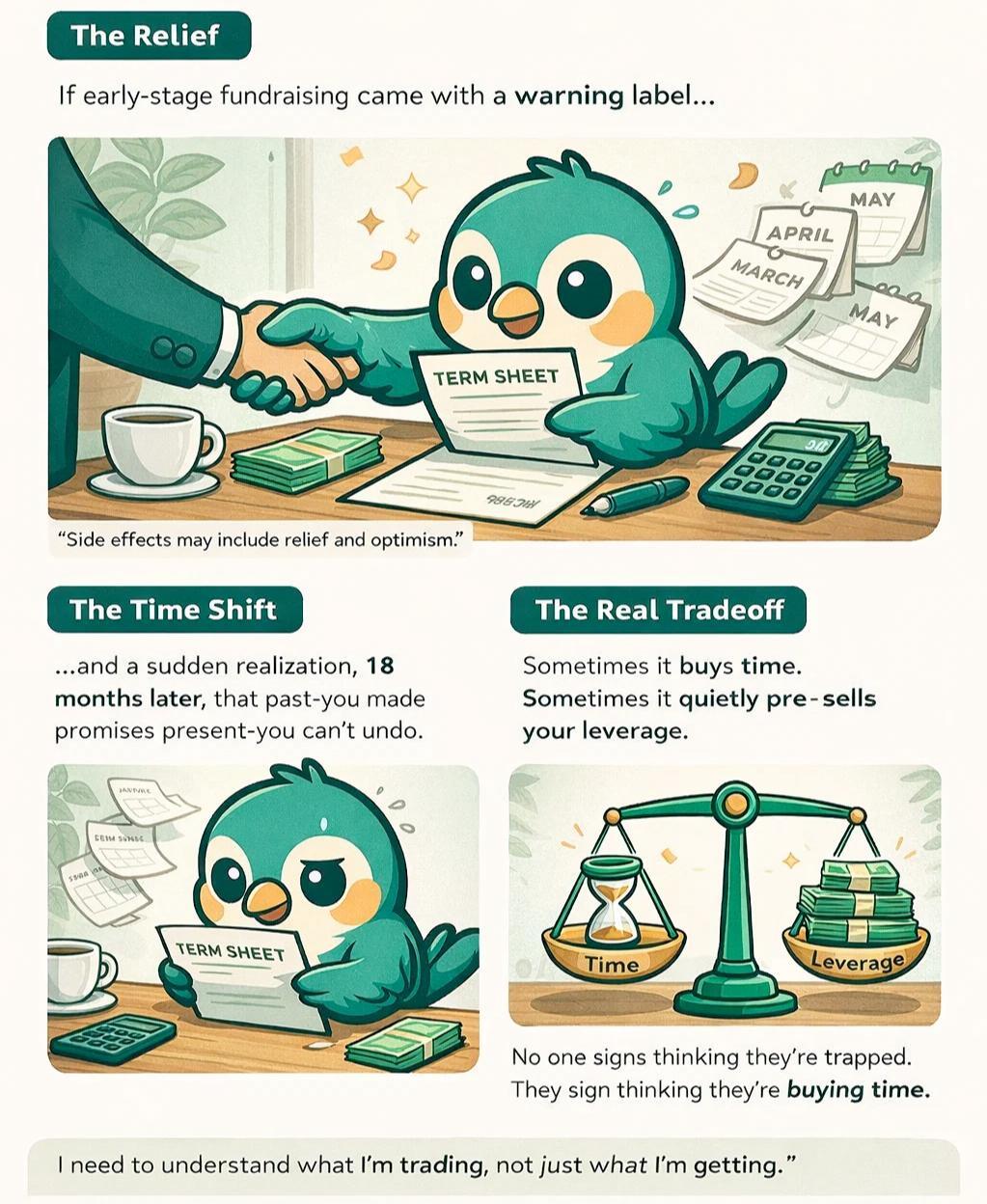

What “Blowing Yourself Up” Actually Looks Like

Early-stage funding is not about money.

It’s about choosing which pressure you’re willing to live with later.

Every dollar solves today’s problem

by creating a future obligation.

Founders don’t blow themselves up by raising money.

They blow themselves up when stored pressure finally meets stress.

And that moment rarely looks dramatic.

Not bankruptcy. Not failure headlines.

Real blow-ups are quieter.

They sound like:

waking up after a conversion and realizing you lost more ownership than expected

discovering you can’t raise cleanly because old terms now run the conversation

feeling trapped between survival and dilution, you never rehearsed

realizing future-you has no room left to maneuver

The common thread?

Past-you made binding decisions without protecting future-you.

The Filters (With Teeth)

These are not reflective questions.

These are decision constraints.

If you can’t answer them, pause. That pause is how you protect future-you.

Filter #1: What Specific Uncertainty Am I Buying Time to Resolve?

Not “runway.” Not “growth.”

Name the uncertainty.

Examples:

“Can we convert pilots into paying customers?”

“Can this team ship the core product?”

“Can we hit $X MRR consistently?”

If the uncertainty is vague, you’re not buying time, you’re renting hope.

Once this money is spent, you can’t retroactively decide what it was for.

Filter #2: What Must Be True Before This Money Runs Out?

Write 3 concrete conditions.

Not goals. Conditions.

Example:

“At least 3 customers pay without discounts.”

“Gross margin exceeds X%.”

“One repeatable acquisition channel exists.”

If the conditions aren’t met, the capital failed its job.

Raising again without hitting your conditions stacks pressure instead of resolving it.

Avoid raising extra capital for hard clarity and paying for it later.

Filter #3: When Does This Decision Come Due Again, Exactly?

Not “next round.”

Put a date or event.

Examples:

“12 months or a priced round, whichever comes first.”

“When notes convert.”

“When new investors diligence the cap table.”

If you don’t know when you’ll have to face this decision again, you’ve surrendered control of timing.

When the clock triggers, you won’t be negotiating from theory, you’ll be negotiating from necessity.

Stop accepting open-ended instruments casually.

Filter #4: What Is the Worst Ownership Outcome I Am Willing to Accept?

Put a number on it. Not “some dilution.”

Actual founder ownership after conversion.

If you don’t know the number, you don’t know the cost.

Once ownership shifts, there is no ‘undo.’

Even success doesn’t rewind dilution.

Model outcomes before signing.

Filter #5: Who Gains Leverage If Things Go Well, but Not Perfectly?

This is the most uncomfortable filter.

Ask:

If we improve, but not explosively, who benefits?

Who gets downside protection and upside optionality?

If the answer is “everyone but me,” pause.

Leverage gained in the middle outcome rarely returns.

Stop confusing optimism with alignment.

The Mistake Pattern

Most founders don’t consciously choose bad outcomes.

They don’t wake up planning to give away leverage or corner future-them.

What they choose is speed.

Speed feels responsible: payroll is coming, momentum matters, and there’s always the quiet promise of “we’ll clean this up later.”

So valuation, ownership, and timing become negotiable once progress is made.

But success doesn’t erase contracts.

It activates them.

The goal isn’t to move slowly.

It’s to move with authorship intact.

These filters don’t slow you down.

They make sure future-you isn’t trapped inside today’s optimism.

Community Note

There’s a reason these mistakes feel universal.

If you’ve ever looked back at a funding decision and thought, “Well… that seemed like a good idea at the time,” welcome. You’re among friends.

Almost every founder has a funding decision they’d renegotiate with the benefit of sleep, hindsight, and a calmer nervous system. That doesn’t make you careless, it makes you human.

NestLedger is where founders compare notes, trade hard-earned clarity, and help future versions of themselves and each other sleep a little better.